holiday economic disaster

Sure. It's the holidays and you're feeling ebullient. You want to feel good and spend freely.

You buy a lot of stuff you don't have money for and it's okay 'cause you got this loan at a really great rate. Of course you won't have the money to pay it off when it comes due--and there's no telling what the new interest rate will be, but that's far off in the future so why worry now? Let's spend!

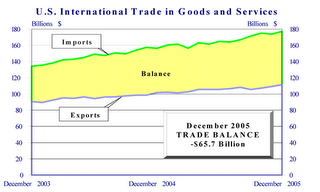

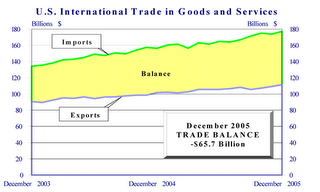

Does that sound like Christmas for a lot of people? Probably. Unfortunately it's also the relationship between the USA and China. We in the US are buying Chinese toys and durables in quantities that boggle the mind and this trade inbalance is funded by US consumers with the Chinese government using the profits to buy up US dept in the form of Treasury bonds. This keeps the ebullient feelings going by keeping interest rates low. However should China stop buying bonds, then the interest rates will quickly pop up to more realistic levels. Talk about coal in the collective US stocking! Mortgage rates would soar so anyone out there with a variable rate mortgage (ARM) would feel the pain quickly though people with consumer credit card dept would feel it first.

Does that sound like Christmas for a lot of people? Probably. Unfortunately it's also the relationship between the USA and China. We in the US are buying Chinese toys and durables in quantities that boggle the mind and this trade inbalance is funded by US consumers with the Chinese government using the profits to buy up US dept in the form of Treasury bonds. This keeps the ebullient feelings going by keeping interest rates low. However should China stop buying bonds, then the interest rates will quickly pop up to more realistic levels. Talk about coal in the collective US stocking! Mortgage rates would soar so anyone out there with a variable rate mortgage (ARM) would feel the pain quickly though people with consumer credit card dept would feel it first.

Just something to think about when you're out and about buying up holiday gifts. We're in an economic bubble and it's only going to last until the next round of reforms in China.

By the way, in case you're curious the interest paid last year on the national debt of 2 TRILLION dollars was over 352 BILLION dollars. That's more than the war in Iraq is costing. And that's just the interest on our debt, and as I said, the interest rate is artificially low as a result of net importing nations like China and Japan subsidizing our trade imbalance to ensure our continued buying of their goods.

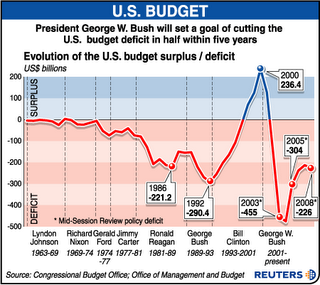

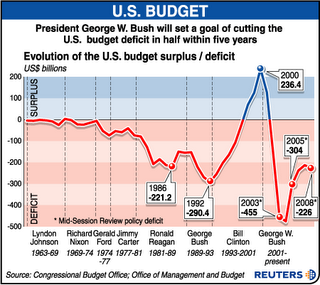

What will happen if that interest rate goes up? Sure, $350 billion is a lot of money but it could easily jump this next year to being over $500 billion. Not exactly chump change and it goes to show you how good Republicans are at economics. Clinton had the annual budget balanced when he left office. And with OMB projecting the national debt to be paid off in 5 years--which was last year, 2005, in case you're keeping track. No debt under Clinton; 2 trillion in debt under Bush.

What will happen if that interest rate goes up? Sure, $350 billion is a lot of money but it could easily jump this next year to being over $500 billion. Not exactly chump change and it goes to show you how good Republicans are at economics. Clinton had the annual budget balanced when he left office. And with OMB projecting the national debt to be paid off in 5 years--which was last year, 2005, in case you're keeping track. No debt under Clinton; 2 trillion in debt under Bush.

Do you think Dubya took economics at Yale or just partied at his frat? I'm just saying...

You buy a lot of stuff you don't have money for and it's okay 'cause you got this loan at a really great rate. Of course you won't have the money to pay it off when it comes due--and there's no telling what the new interest rate will be, but that's far off in the future so why worry now? Let's spend!

Does that sound like Christmas for a lot of people? Probably. Unfortunately it's also the relationship between the USA and China. We in the US are buying Chinese toys and durables in quantities that boggle the mind and this trade inbalance is funded by US consumers with the Chinese government using the profits to buy up US dept in the form of Treasury bonds. This keeps the ebullient feelings going by keeping interest rates low. However should China stop buying bonds, then the interest rates will quickly pop up to more realistic levels. Talk about coal in the collective US stocking! Mortgage rates would soar so anyone out there with a variable rate mortgage (ARM) would feel the pain quickly though people with consumer credit card dept would feel it first.

Does that sound like Christmas for a lot of people? Probably. Unfortunately it's also the relationship between the USA and China. We in the US are buying Chinese toys and durables in quantities that boggle the mind and this trade inbalance is funded by US consumers with the Chinese government using the profits to buy up US dept in the form of Treasury bonds. This keeps the ebullient feelings going by keeping interest rates low. However should China stop buying bonds, then the interest rates will quickly pop up to more realistic levels. Talk about coal in the collective US stocking! Mortgage rates would soar so anyone out there with a variable rate mortgage (ARM) would feel the pain quickly though people with consumer credit card dept would feel it first.Just something to think about when you're out and about buying up holiday gifts. We're in an economic bubble and it's only going to last until the next round of reforms in China.

By the way, in case you're curious the interest paid last year on the national debt of 2 TRILLION dollars was over 352 BILLION dollars. That's more than the war in Iraq is costing. And that's just the interest on our debt, and as I said, the interest rate is artificially low as a result of net importing nations like China and Japan subsidizing our trade imbalance to ensure our continued buying of their goods.

What will happen if that interest rate goes up? Sure, $350 billion is a lot of money but it could easily jump this next year to being over $500 billion. Not exactly chump change and it goes to show you how good Republicans are at economics. Clinton had the annual budget balanced when he left office. And with OMB projecting the national debt to be paid off in 5 years--which was last year, 2005, in case you're keeping track. No debt under Clinton; 2 trillion in debt under Bush.

What will happen if that interest rate goes up? Sure, $350 billion is a lot of money but it could easily jump this next year to being over $500 billion. Not exactly chump change and it goes to show you how good Republicans are at economics. Clinton had the annual budget balanced when he left office. And with OMB projecting the national debt to be paid off in 5 years--which was last year, 2005, in case you're keeping track. No debt under Clinton; 2 trillion in debt under Bush.Do you think Dubya took economics at Yale or just partied at his frat? I'm just saying...

Comments

Michele sent me. :)

I'm surprised at your laud to the Clinton administration, given your current geographic location. Isn't that agin't (sic) the law down there?

Yes, there are some very sketchy and horrifying rationales for the way business is done. I foresee a future akin to Post WW I Germany, where a wheelbarrow of Deutscmarks might've bought you a loaf of bread. Frightening thought. I'll be teaching my sons several choice foreign languages in an effort to help them weather the oncoming economic sh*tstorm.

The day of reckoning vis-a-vis U.S. fiscal policy is definitely coming. Sadly, political cycles are such that today's elected leaders will be long gone by the time that happens. We are so short-sighted in the way we run governments - and businesses, mind you - that it's almost too sad to contemplate.

I fear for the future, and hope there is some way out of this mess.

ebullient...new word for this girl.

Sometimes I think we should return to the times when big items such as TV, microwaves, appliances, cell phones, computers.... everything was relatively more expensive. There used to be jobs for people skilled at repair.... now it's a disposable world.

I remember Clinton having the budget under control. I haven't paid much attention to national finances since then, since mostly i am just trying to pay attention to my own! Paying the rent is enough of a challenge. We are fortunate that we don't really have any consumer debt. No credit cards, our car is just 2 payments from paid off, but we know that financial disaster is just 2 sick days away.

kind of depressing when you realize that the US government has our nation in the same kind of precarious financial spot.

Michele sent me boomaranging your way Dave.

Hi from Micheles today!

Mind you, we have our own idiot up here right now too. Oy.

Michele sent me.

Long after Dubya fades from public view, living off the teat of the public purse in Crawford, the world will still be paying the price on so many levels.